Data Report: Marketing Role & Team Growth at B2B Startups

Collaboration with Live Data Technologies

📈 This is a bonus monthly edition of MKT1 Newsletter for free and paid subscribers. To receive an additional newsletter each month, attend our office hours, read newsletter archives, post to our job board, and access our template library become a paid subscriber.

A few weeks ago, I saw some informative data on the state of product roles in Lenny’s Newsletter in a collaboration with Jason Salzman from Live Data Technologies. So I was thrilled when Jason reached out wanting to help provide similar data for MKT1 Newsletter. And it was very aptly timed, since this month’s newsletter have been about marketing org charts.

Highlights:

The data showed 52,000 active marketers at US-based B2B startups right now, and on average 450 to 600 were hired into new roles each month in 2024.

There are ~3,350 marketing leadership roles today and ~4,200 sales leadership roles today at B2B Startups, which is significantly more than the ~2,850 and ~3,500 back in Q1 2019. It certainly doesn’t feel that way though!

Product marketing and marketing leadership roles appear to be on an upswing right now, while roles in Content & Brand and Growth Marketing & Demand Gen areas are not growing compared to last year.

This newsletter is part 3 of a 3 newsletter series on marketing org charts:

Guide to marketing org charts (last week): Explains and shows how to organize teams from 5-25+ people.

Org Chart FAQ (sent this week to paid subscribers only): Common questions about building your marketing org with input from marketing leaders from Mercury, Front, Lattice, Apollo.io, Cocoon, and more. It also includes current marketing org charts from Mercury and Cocoon.

Data on marketing roles (this post!): Deep dive into marketing org chart hiring data with Live Data Technologies.

Recommended products and agencies

We only include sponsors we’d recommend personally to our community and copy is in Emily’s words. If you are interested in sponsoring our newsletter, email us at sponsorships@mkt1.co.

📇 Apollo.io integrates a lead database, multi-channel outreach, call recording, and analytics, cutting down the need for multiple tools. Marketers overseeing outbound, growth marketers, and demand gen leaders love it as it streamlines their workflows.

Offer: Learn more about effective outbound in Apollo’s guide or sign up for a free Apollo account today (no card required).

_

🎯 Positional is the all-in-one toolset for startups to start, grow, and scale their content marketing & SEO strategy. We recommend their product because it provides actionable recommendations—from SEO and webpage optimizations to internal linking opportunities. Whether on content or growth marketing, you’ll find it valuable.

Offer: Positional just launched self-serve—my favorite way to buy! Get 20% off by mentioning MKT1 at checkout.

_

📊 Paramark: Identify and predict the most effective marketing activities with Pararmark. It uses statistics and AI—instead of touch-based attribution—to tell you how to shift spend across your channels. Use Paramark to inform what activities your entire marketing team should focus on.

Offer: Mention MKT1 and get a 15% discount if you sign by 2024.

Marketing org & role trends

Quick note on data & methodology, more details at the bottom of the newsletter: This data on employment changes in the U.S. at B2B Startups came from Live Data Technologies. They use public information and proprietary processes to monitor job changes for over 88 million professionals, tracking hiring trends across companies, roles, functions, levels, industries, and locations.

Role & team growth over time

We looked at the relative growth of job titles within marketing and across sub-functions to get a sense of how B2B startup marketing is growing. To interpret these charts, if the growth index on the y-axis is 115, this means there are 15% more roles compared to 2019, when the base index of 100 was set.

While marketing is leaner than it was compared to the peak in mid-2022, there are still way more jobs than in 2019.

Marketing sub-function growth:

To understand scale here, there are ~7,600 Product Marketing roles at US-based B2B startups right now, in Q3 2022 peak there were ~8,450, and at the start of this graph in Q1 2019, there were ~4,500.

All of these lines follow the same shape, but marketing leadership (VPs & CMOs) has remained flatter over time. And I guess this makes sense, as there’s only 1 or 2 of these per organization.

Product marketing and marketing leadership roles look back on the upswing in terms of growth.

Product marketing and marketing leadership roles appear to be on an upswing right now, while content & growth roles are slightly lower or flat compared to a year ago.

Marketing vs. sales-leadership growth: We’ve moved from growth at all costs to efficient growth over the last 5 years, so I was curious if those changes impacted sales leadership roles more so than marketing leadership roles.

To understand scale here, there are ~3,350 marketing leadership roles today and ~4,200 sales leadership roles today, compared to ~2,850 and ~3,500 back in Q1 2019.

It looks like marketing team leaders had a real moment compared to sales in 2020. We started off the pandemic with steady hiring in marketing leadership.

We then saw a surge in marketing and sales leader hiring as startup funding was getting crazy high.

Then, when things started to go south in startup valuations and fundraising, GTM leadership hiring stopped growing so quickly, but it still up from pre-pandemic levels.

And now, it looks like sales leader growth has exceeded marketing leadership growth. I see this anecdotally, but I find it surprising. As a forever advocate for marketing, marketing provides tons of leverage to an organization and doesn’t have to grow linearly with revenue like sales. But as I frequently write, that’s a whole other newsletter…

Marketing role growth compared to other startup teams: Sales & marketing team growth is slower than product & engineering, no surprises here! Some other observations:

I didn’t realize how much growth there’s been in CS roles since 2020. I guess we are seeing the value of retaining and upselling customers more than ever?

While in the marketing vs. sales leadership chart above where sales was typically growing more than marketing, that’s not the case when you factor in the whole team, not just the leaders.

New: Monthly Office Hours with Emily Kramer

Free for Paid Subscribers, starting next week on 9/4

I’m now hosting AMAs on my monthly newsletter topic. These events are free for paid subscribers. Office hours will always be super casual (no slides or presentations) and this month’s event will focus on your specific questions about org charts and marketing roles.

Free subscribers: I recommend updating to be a paid subscriber to attend: you’ll get free access to this event, our templates, all full-length posts, etc. for <$10/month.

Paid subscribers: You can find your discount code at the bottom of this newsletter or in this post.

Hiring trends by role and title

These next 3 graphs break down headcount changes. Each graph shows the net headcount growth (arrivals-departures) for each role grouping.

Categorization note, for all of the graphs:

Content Marketing includes Content Marketing, Brand, and Design roles (but that was too long to fit in the graph titles).

Growth & Demand Gen includes roles like social, performance, SEO, and email.

Product marketing includes partner marketing too.

The complete breakdown of what’s included in each bucket is at the bottom of the newsletter in the data & methodology section—it’s obviously really hard to categorize all roles into 3 sub-functions (hence writing 2 newsletters this month on this topic), but we did the best we could here!

Some takeaways from these 3 graphs on headcount growth:

Lots of marketers were hired in 2021 into early 2022, followed by a quick decline. Headcount for marketing still is NOT growing, but it looks like the worst is now behind us? This reflects the macrotrends in startup growth as well.

Junior/entry-level and manager roles show the largest changes—this makes sense as there are just more humans in these roles than senior roles.

That said, there was a lot of change in senior level roles too, so headcount changes weren’t isolated to any particular job level of marketers.

See anything else interesting here? Let me know in the comments.

Marketing titles: We’ve created a mess

Content, brand, and growth marketing titles and roles are changing rapidly due to AI, no-code, etc, so we wanted to to give you a sense of just how many titles there are. Hint: the long tail here is a very long tail and we really can’t come to a consensus on what to call ourselves!

Content marketing titles: Even the most common title (“technical writer”) represented under 3% of all titles in this category. I found it surprising that “technical writer” was more popular than content marketing manager. But the real takeaway here is that there’s no standardization on titles—and we are starting to see producer roles pop up. (I advocated for every team having a “producer” or generalist role that connects fuel and engine in my newsletter last week and the discussion on this was quite lively on LinkedIn).

Growth marketing & demand gen titles: For Growth Marketing and Demand Gen, I was really curious if more people had “Growth Marketing” in their title vs “Demand Gen”, but it seems like we are still stuck in the 2010s, and “Digital marketing” reigns supreme.

Here’s the breakdown of how many people hold titles with those exact words in them:

Marketers with “Digital marketing” in title: 1403 out of our sample of 710K+ current employees of B2B startups

Marketers with “Growth marketing” in title: 1170 out of our sample of 710K+ current employees of B2B startups

Marketers with “Demand gen” in title: 832 out of our sample of 710K+ current employees of B2B startups

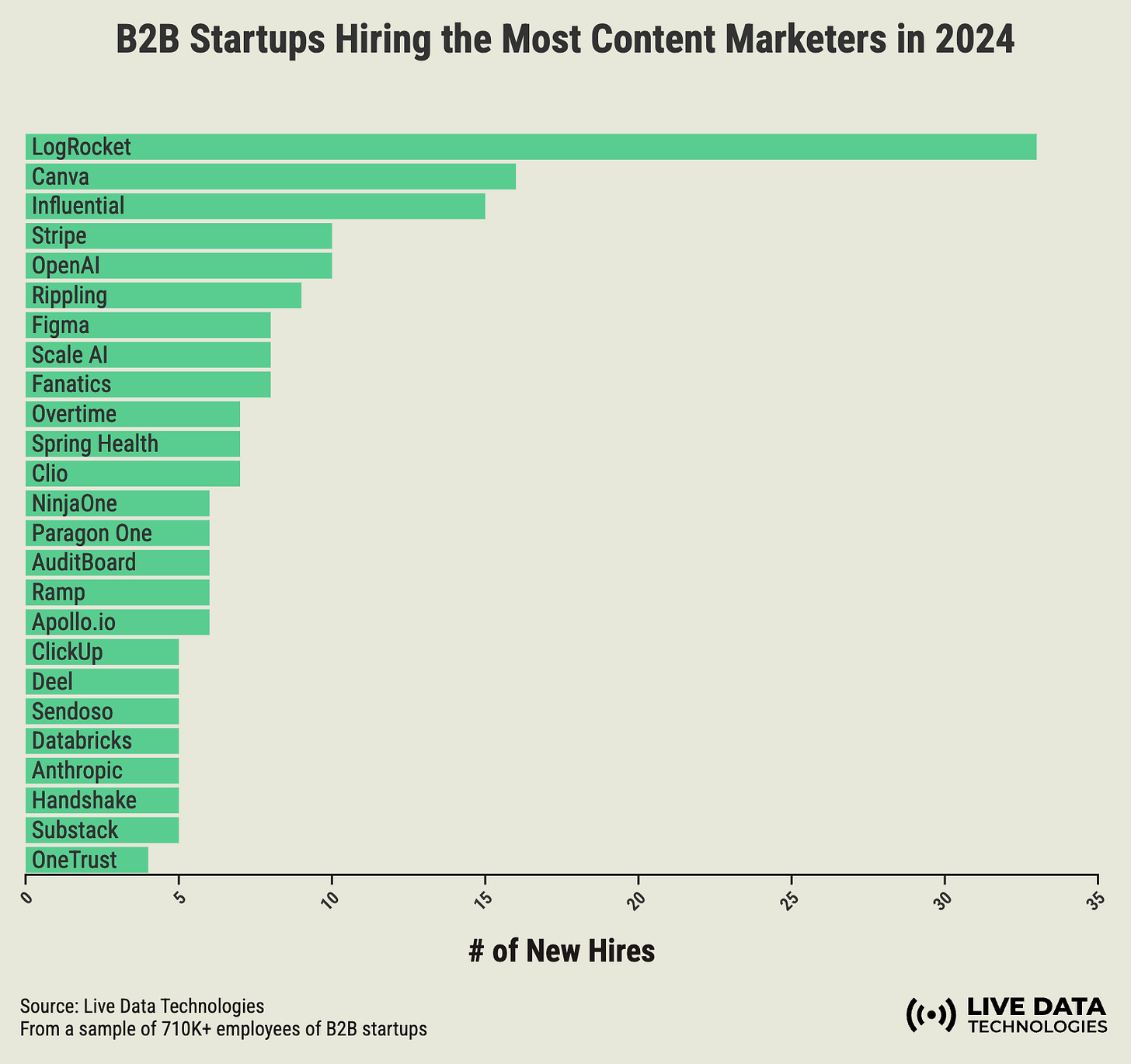

Which startups are hiring marketers quickly?

The next data set is just kind of fun to see—we looked at which companies have hired the most marketers in each area of marketing so far this year.

Note: We looked at the # of new individuals holding those job titles at each company (we did not look at job posting data, so repeat listings for the same job were not double counted).

Content hiring: I had never heard of LogRocket until seeing this, but they posted nearly 35 content roles in 2024! They have nearly ~700 employees according to LinkedIn. And it’s great to see that Canva invests so much in content as they are platform for content creators after all.

Growth hiring: I do feel like every other growth marketer I meet works at or has worked at Rippling, so kind of makes sense that they’ve had over 30 growth marketing roles listed this year. Revlocal helps local businesses with “digital marketing”, so it makes sense they hire so much there.

PMM hiring: Ramp brought in a lot of new product marketers…and it wasn’t even close to Databricks which hired the 2nd most. I guess there’s a lot of positioning to do to differentiate from Brex, Mercury, etc. or maybe they have tons of product launches planned?

Where to find a ______ marketer…

If you want to bump into a marketing leader (VP to CMO) on the street, you should go to the Bay Area, NYC area or Boston area. While there are more options to go remote or hybrid, we are still concentrated in the tech hubs.

People not in the sub-functions of marketing seem substantially more spread out than the marketing leaders. And anecdotally, it does seem like executive-level roles have less flexibility in being 100% remote.

Note: These graphs show the top 75 MSAs, so if you don’t see a dot for yourself in the middle of say NH ,that’s why—and yes, I am in fact in the middle of NH right now.

More from MKT1

🙏 Thanks again to our sponsors: Apollo: to build quality outbound pipeline efficiently; Positional: the all-in-one toolset for content marketing & SEO strategy; and Paramark, a new way to measure marketing performance.

🙏 Thanks again to Jason Saltzman and Live Data Technologies for sharing this interesting data with us. For more ongoing insights from the data, check out Jason’s newsletter, Human Capitalist. And if you’re looking to stay up to date on the latest job changes at top companies, Live Data’s free trial allows you to track up to five companies.

✂️ Templates for paid subscribers: Paid subscribers can find org chart and job description templates here and our template library here.

🧑🚀 Job board: Jobs from the MKT1 community. Paid subscribers can now add jobs to our job board for free!

Events from the MKT1 Community

🕐 Reminder that I’m launching monthly office hours to answer any questions about that month's org chart newsletters live on 9/14. This event is free for paid subscribers. More details & discount code for paid subscribers.

🎟️ The <code/> growth conference—focused on AI in growth and marketing—is coming up on September 24 in SF. Grab your tickets here.

🍻 42 agency is hosting a Happy Hour at Hubspot Inbound on 9/18 and I’m the “featured” guest, would love to see you there. RSVP here.

Thanks for reading!

-Emily

Appendix: Data sources & methodology

I’ve always wanted to have an appendix in a newsletter, and today’s the day!

All data comes from Live Data Technologies. Live Data Technologies has developed a method of prompt-engineering major search engines (e.g. Google, Bing, Baidu, Yandex, etc.) to capture near-real-time data on employment changes in the U.S. Leveraging this publicly available information, they use proprietary processes to monitor job changes for 88M+ white-collar professionals. They track job changes and hiring trends across companies, roles, functions, levels, industries, and locations.

The company normally sells this data to investors (e.g. VCs, private equity), startups (e.g. platforms that incorporate people data), HR orgs, and go-to-market leaders, and serves as a data resource to media outlets (e.g. the Wall Street Journal, The Economist)

We organized roles and levels into the following categories:

Team Leadership: Head of Marketing, VP, SVP, CMO

Director: Head of [Subfunction], Senior Director, Director, Lead

Manager: Senior Manager, Sr. Manager, Manager

Junior: Associate, Assistant, Specialist, and Coordinator.

For each “sub-function” of marketing we included the following roles:

Product Marketing: product marketing, product marketer, PMM, partner marketer, partner marketing, partnerships marketing, product launch, sales enablement.

Content & Brand Marketing: content marketer, content, copywriter, writer, content producer, creator, media producer, producer, marketing designer, comms designer, brand designer, communications designer, web designer, customer marketer, brand marketer, brand marketing, employer marketing, employer brand.

Comms & PR, nested under Content & Brand Marketing: PR, comms, analyst relations, public relations, marcom.

Growth Marketing & Demand Gen: demand gen, demand generation, digital marketing, digital marketer, digital, account-based marketing, ABM, paid, performance, SEM, ads, advertising, SEO, CPC, organic search, search, email marketing, email marketer, email, lifecycle marketing, lifecycle marketer, inbound, organic marketing, outbound, marketing development rep, MDR.

Marketing Ops, nested under Growth Marketing & Demand Gen: web producer, marketing ops, marketing automation, marketing tech, marketing technology, and MOps

Events & Community, nested under Growth Marketing & Demand Gen, includes field marketing, field, events, community, social, social media, and event producer.