Positioning & messaging teardown, with Anthony Pierri

MKT1 Newsletter “Extra” | Emily & Anthony review 3 startups’ positioning statements and homepage copy

👋 This is a monthly free edition of MKT1 Newsletter—a deep dive into a B2B startup marketing topic. This edition is brought to you by Ignition, Ten Speed, & 42 Agency. Become a paid subscriber to receive an additional 1-2 newsletters each month, access our archives, post to our job board, and use our template library.

Even when startups write the perfect positioning statement, the hard part unfortunately isn’t over. When startups turn positioning into messaging and then into copy, the original positioning is often lost completely and the result is copy that falls flat. I of course wouldn’t leave you hanging half way through a process, so as a follow up to my Guide to Positioning newsletter, this newsletter provides examples of how to turn positioning into homepage copy through 3 real startup examples.

Note: My partner says “teardown” sounds negative, so I guess these are actually “tearups”? In any case, this newsletter features constructive feedback to make solid positioning even better.

Meet Anthony Pierri

I also called in an expert on this topic, Anthony Pierri, to help evaluate these startups’ positioning and messaging. Anthony is co-founder of FletchPMM, a product marketing consultancy for early stage startups, and has helped over 200 founders rewrite their homepages with stronger positioning, messaging, and copy. Plus, he’s my favorite person to follow on Linkedin for homepage-related content. Here a few of his posts:

Brought to you by…

While these suggestions are sponsored, I personally recommend these products & agencies to companies I work with. If you are interested in sponsoring our newsletter, email us at sponsorships@mkt1.co.

This newsletter features the perfect trifecta of agencies for startups: With 42 Agency for demand gen and revops, Ten Speed for content and organic growth, and Anthony for positioning and messaging…you can’t lose! Plus, a product that can help you with positioning research & insights, Ignition.

__

42 Agency is the Demand Generation & RevOps Partner for B2B Companies with $10-$100M in ARR. I continue to recommend 42 Agency because they think holistically about driving revenue and are constantly evolving their approach. Here’s proof: They take accountability on revenue & pipeline, not traffic & leads; they set up sophisticated measurement and forecasting—and can even help you with creative.

Offer: Reach out to 42 Agency here and Mention MKT1 to get $1200 off your first month.

___

Ten Speed, an organic growth agency for early & growth-stage SaaS companies, also has a permanent spot on my recommended agencies list. When it comes to content strategy, execution, and distribution, they just get it. Ten Speed handles everything from SEO content and authority content to research reports and repurposing content…so you can tell your story and reinforce your positioning.

Offer: Reach out to Ten Speed here & mention MKT1 to get $1,000 off your first month or a research report–and subscribe on Substack.

___

Ignition: There’s never been a source of truth platform for product marketers—but Ignition is becoming just that. It connects the dots across product marketing, product, and sales so you can bring products to market—and write positioning—faster. My favorite feature: Ignition’s AI continuously analyzes competitor and customer data, giving you (and your product team) insights needed to differentiate.

Offer: Get 3 months of Ignition free when you enter MKT13 at checkout.

Overview of positioning process

If you read the last newsletter in detail, you can skip this.

The positioning process starts with product marketing research (audience, competitive, and product analysis) and ends with copywriting. For more on the difference between positioning, messaging, and copy, check out this LI post.

After the research phase and before you write your positioning statement, you should choose a product type and a comparator to ground your positioning. Note: Your product type, comparator, and overall positioning can—and likely will—change over time.

Once you determine your product type, then determine who your product is for?, what is your product? and why is it better?—in that specific order. You then refine your positioning to create messaging for audience segments, funnel, stages, channels, etc. Once you have messaging you can write copy for a specific asset or channel, like your homepage.

When writing homepage hero copy, you should always cover your positioning including the who, what, and why. I wrote all about this in one of my most popular newsletters a while back.

Positioning & messaging teardowns, featuring: Pocus, Orb & Blaze

These startups all submitted their positioning and homepage messaging for review. I selected startups across 3 of the 4 product types and comparators. I also decided to pick startups who target marketers, engineers, and founders to make sure the products were easy for readers to grasp quickly.

Full disclosure: Pocus is an MKT1 Capital portfolio company, I’ve done advising workshops with Orb. I have no connection to Blaze (yet?!)

Pocus

Pocus teardown by Emily of MKT1

Positioning Pocus is a tough job.

I’m an investor in Pocus, and I know first hand how much this space evolves every few months. And just a couple weeks back they announced a new version of Pocus, shifting from a product-led sales data focus to a broader focus. This required a positioning and messaging update—without confusing people already aware of Pocus.

Pocus is correct to position against the “old way”, not competitors in their emerging category

Lots of players have popped up to give GTM teams better access to demographic, firmographic, and behavioral data, and many also add on workflows to reach those prospects and companies.

Yet, most GTM teams still rely on old ways of doing things: manual prospecting, basic retargeting, dated lead scoring methods, and little access to product data.

Despite the temptation, Pocus should still be positioning against the old way of doing things today, not their emerging “competitors”. So, I agree with what Pocus has selected as their comparator.

As the category gets more established, they’ll will need to shift to 10x better positioning to show why they’re better than competitors.

Find a “land” use case to focus on, rather than trying to say it all

Tools like Pocus can be used to solve lots of problems and help with lots of workflows. But, saying everything in positioning and homepage copy gets confusing.

It’s essential to identify the best top-of-funnel use case for your primary audience and focus there when writing positioning and homepage messaging. Pocus’ copy will be more effective once they do this.

Focus on sales as a primary audience, not on all GTM teams

Lots of tools in this space are unsure who their best audience is—sales, marketing, customer success, revops—likely because GTM teams as a whole are evolving rapidly due to AI. But trying to target them all at once leads to a very muddled message.

Startups should focus their core positioning and therefore their homepage hero on their primary audience, and route other ICPS to audience-specific content. You can make distinct pages for each audience or use tools like Mutiny or Tofu to dynamically personalize pages for the audience segment. And if you need to do customer research to guide positioning, check out our sponsor Ignition.

For Pocus, I’d recommend they focus on sales as their primary audience on their homepage.

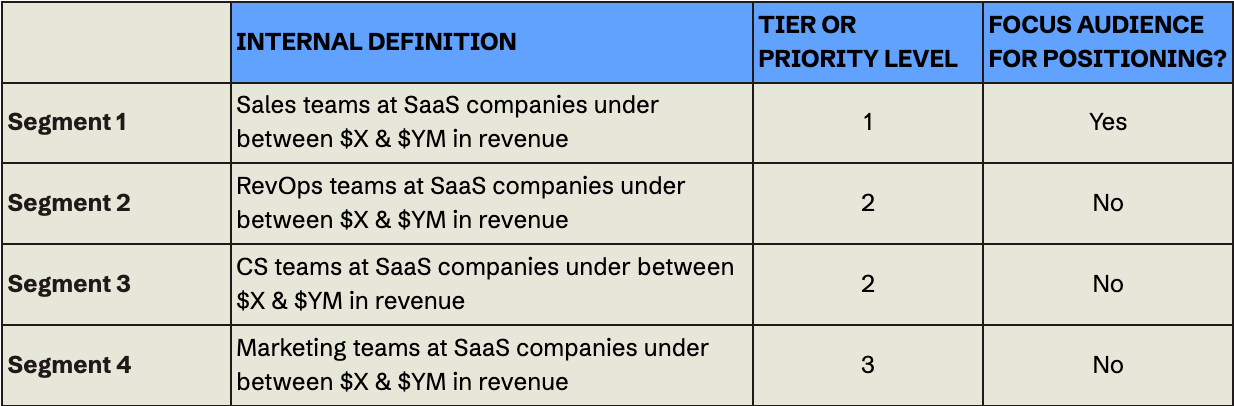

This simple template may help with prioritizing audiences, paid subscribers can find templates here.

Pocus teardown by Anthony Pierri

As Emily pointed out, the sales tech space is very crowded. It can be extremely hard for buyers to keep track of the different solutions, what categories they fall into, when they should use them… especially when companies keep inventing new categories overnight (looking at you, Gong).

To make matters worse, almost all sales-related startups promise the same thing: increasing revenue.

The quickest way for sales-tech companies to remove their differentiation and blend in…is to talk about how they increase revenue. (Ironically, I featured Pocus in a post about this exact topic over 1 year ago.)

As a consequence, I don’t think statements like “Build pipeline and close more revenue, consistently” should be included in the hero (or anywhere else in the top ⅓ of the page, to be honest).

All that aside… here is the key question Pocus needs to answer (IMO) to really nail this positioning:

Is Pocus targeting a very modern, knowledgeable sales org? Or are they targeting a legacy sales org?

The page talks about the problems of the “old way” — but then goes on to show the new way without explaining any of the “new way” tactics.

Within one scroll to the problem section, we read that Pocus powers:

“GTM playbooks”, “Product-led sales”, “Warm prospecting” , “1st party data”, & “Rich intent signals.”

All of these concepts are very familiar—to very modern SaaS sales orgs. Step outside VC-backed SaaS and the legacy companies will likely have way less understanding of what these phrases mean.

If Pocus is going after modern sales orgs, then I would shift positioning—you’d want to answer “why is it so hard to do product-led sales, warm prospecting, etc?” Assuming this, I would show Pocus’ differentiation directly against those competitive tools or workflows for those use cases—and say why they suck.

However, if Pocus is targeting legacy companies doing things the “old way” as Emily puts it, I would focus on differentiating against the status quo ways of operating and then drastically reduce the amount of new use cases you’re introducing.

As a comparison, imagine you’re a guitar teacher and someone comes to you saying they want to learn to play. You’ll likely scare them off by saying “I’m going to teach you hybrid picking, artificial harmonics, polyrhythms and metric modulation!” You’d likely be better off saying, “I’ll teach you how to play Wonderwall!”

Here is a deeper dive from Anthony on how positioning changes relative to the market’s maturity.

Note: As mentioned in the last newsletter, “New way” positioning is the most difficult of all 4 product types–by far. You need to make your audience problem, solution, and product aware. And, many startups positioning a “new way” attempt to create the perfect category name too early. Instead of naming the category, explain your product with clear, descriptive language. And remember, early competitors playing in the same emerging category typically help you more than hurt you. They’re helping to establish a new way of solving an existing problem.

More from MKT1

✂️ Templates for paid subscribers: Paid subscribers can find all templates here, including the positioning and product marketing templates me and Anthony used in this newsletter!

🧑🚀 Job board: See roles from the MKT community. Paid subscribers can add jobs to our job board for free.

👁️ Related newsletters: Guide to positioning, Creating a homepage, Fixing your demo flow, Effective pricing pages

📖 Keep reading: Paid subscribers get access to the rest of this newsletter which includes teardowns of Blaze & Orb.