Early-stage marketing compensation explained

Salary & equity benchmarks for Seed & Series A marketing roles and how to use them.

This newsletter shares our perspective on early-stage marketing compensation in an attempt to make this process easier for both marketers and founders. We hope this serves as a reference when people get or make offers, and we’ll cover:

Background: Where I got this data and why sharing it matters

Part 1: Early-stage marketing benchmarks: A spreadsheet with ranges for cash and equity for Seed & Series A marketing roles and advice for how to benchmark your equity offer. Plus, an invite to a follow up talk about this post with Emily & Kathleen.

Part 2: Calculating the value of your offer for any role: Including equity basics, a calculator, and questions to ask. Skip down to here if you are unfamiliar with equity, and then come back up to the top. This was a hard post to organize, clearly.

Opportunities for marketers: Open roles and an invite to MKT1 event on navigating marketing comp.

Background

After leading marketing and working on two gender equity gap studies while at Carta, and later filing a lawsuit against the company alleging unequal pay and gender discrimination, I’m determined to help people better understand compensation, especially marketers. Over the past two years, I’ve had hundreds of convos about marketing compensation with founders, investors, recruiters, marketers I coach through the hiring process, and people who submitted offer reviews through a free program I ran last year called Help Wanted Project.

This is my attempt to consolidate that marketing comp information, combined with info Kathleen has gathered (in an anonymized way of course) and make it useful for marketers considering roles at venture-backed companies and founders hiring marketers.

If your marketing offer at a growing, venture-backed Seed or Series A startup doesn’t fall in these ranges—assuming you have the relevant experience and qualifications for the role—make sure you have a clear explanation and understanding of why it doesn’t. After all, it’s still a candidate's market.

Why is it a marketing candidate’s market right now? (Sorry for the tongue twister)

It’s not just your perception, the past year was the most competitive market for early-stage marketers I’ve seen in my 10+ years in startup marketing. With huge rounds being raised, growth expectations are more aggressive and the budget to spend on GTM goes up. So marketers are in high demand. Plus, “supply” of early-stage marketers is constrained for 2 reasons. One, these roles are challenging and often misunderstood by founders and investors. And two, due to market trends staying or joining later stage or public companies in 2020 and 2021 was a great option (remains to be seen if that will continue).

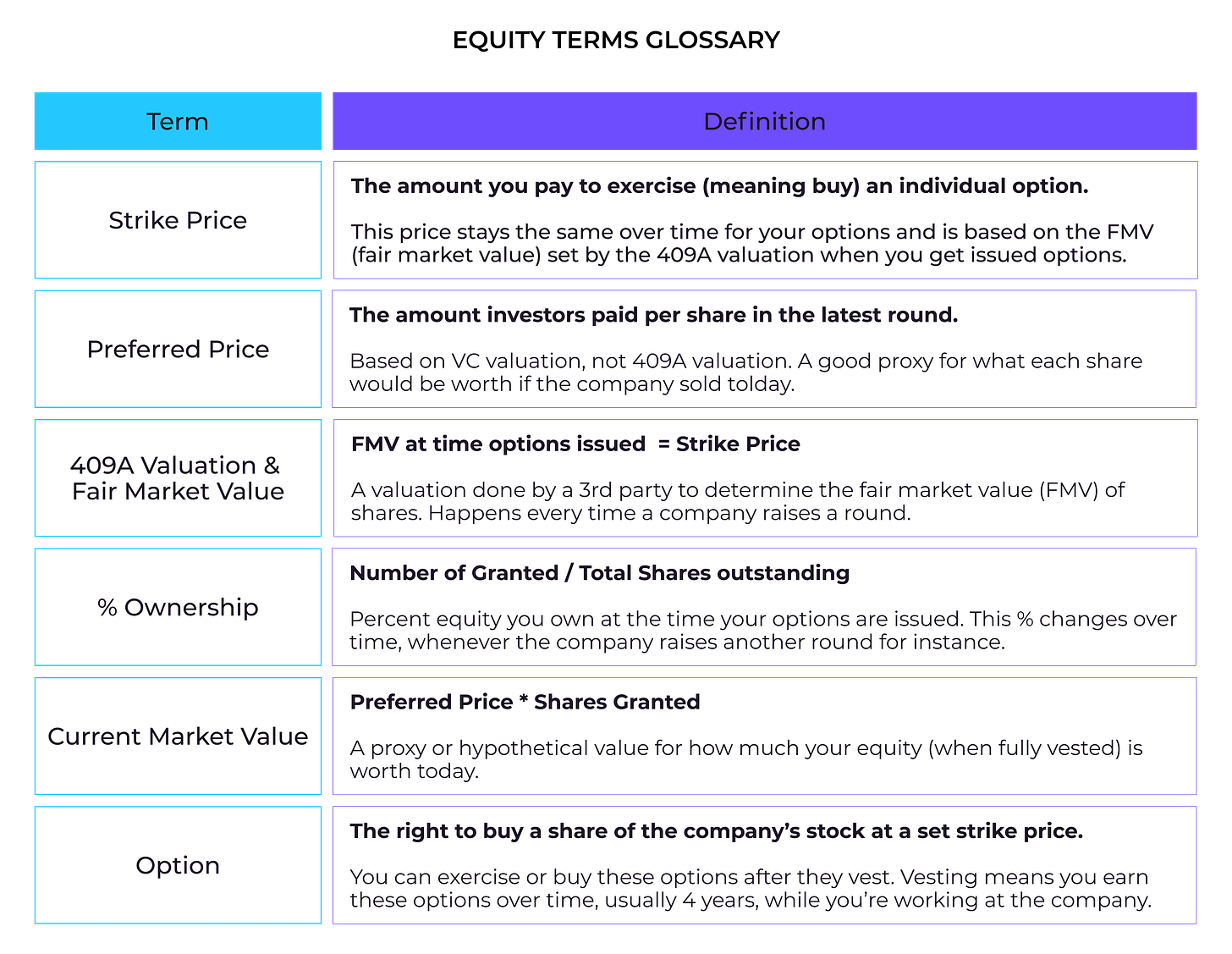

This post has a companion spreadsheet with benchmarks and formulas. And if you need an equity primer, jump to the bottom. There’s even a glossary.

Part 1: Marketing benchmarks

When you get a Seed or Series A marketing offer at a growing, venture-backed startup, see how it compares to these ranges.

Making sense of these benchmarks

Info you need to evaluate your offer: If you only have salary, total number of shares granted and strike price, you do not have enough info to evaluate your offer. You will also need total shares outstanding and/or the latest post-money valuation. Jump down to the bottom of this post for a more detailed explanation and a diagram.

% Ownership: We recommend using % ownership to benchmark equity at Seed and Series A, and current “market” value to benchmark at Series B and later. More on these benchmarking methods and info to ask for to make these calculations later in this post.

Exceptions to these benchmarks are fairly common, despite trying to give broad ranges. If a company has raised more or less than the typical Seed or Series A round, these ranges might be incorrect. If these benchmarks seem high compared to other comp datasets, that’s likely because the sample is more recent and also it’s data from high-growth, top-tier venture-backed startups paying top dollar.

Later stage companies will typically offer more cash and less equity, so bear that in mind. For instance, if a Series A company raises at a valuation closer to a Series B, compensation will likely be higher on cash, and lower on equity.

Seed vs. Series A: We lumped together Seed and Series A companies, and recognize the imperfections of doing this, especially as round names are less and less meaningful. Some Series As are like Series Bs these days, and some Seeds are like Series A.

Marketing comp has changed. This is Seed & Series A startups in “typical” 2020 to early-2022 valuation ranges—if you’ve been at a startup for a while, these numbers might seem really high.

Salary at Seed vs. Series A: At Seed, you should expect a lower salary, closer to the lower end of these ranges. At Series A, expect or negotiate for the mid to higher end of these ranges.

Equity at Seed vs. Series A: At Seed, you should expect the mid to higher equity range to offset the lower salary and theoretically higher risk.

“Low Equity” column: These % ownership benchmarks are common for many Series A companies, but sometimes you’ll see a lower amount at high-valued Series A startups. For Seed-stage companies, the low equity column is very low.

“Typical Equity” column: This is the midpoint I see across early-stage.

“High Equity” column: This would be a really high amount at A, but reasonable at Seed, and sometimes I see even higher at Seed.

Bonuses: We are not including bonus here because we don't see this frequently at early stages for marketers.

Location adjustments: This is what we see in high cost of living cities, like SF and NYC. Not all startups adjust for location, but many do. Find out how the company thinks about it and keep this in mind if you aren’t in one of these locations. Your equity should stay the same, but your salary might go down in another location.

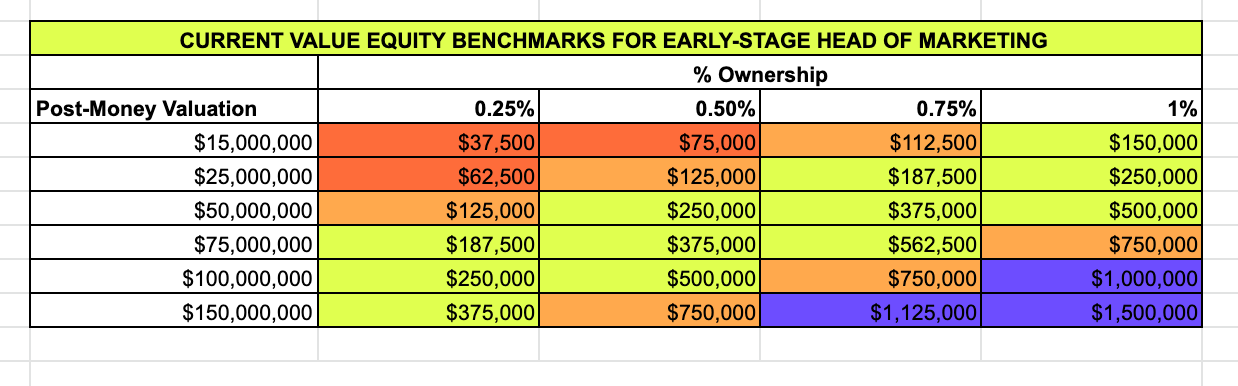

Benchmarking based on current “market” value

Current market value is a good proxy for what your equity (if fully vested) is hypothetically “worth” today. This table shows how % ownership, (VC, post-money) valuation, and current value are related. More on this in the glossary and methods section below.

Using the equity ranges from the % ownership benchmarking table and some hypothetical valuations at Seed & Series A, I created some scenarios that show the current market value of equity offers. It also shows what current market values are in range for a Head of Marketing role at an early-stage startup (note: this is not the current market value ranges for all marketing roles, that’s too complicated for one table!)

Our spreadsheeet also shares sample offers, which illustrate the importance of considering stage, valuation, and the combo of salary and equity when evaluating your offer.

More info on the various methods you can use to evaluate your equity is below and a calculator for figuring out % ownership and current value in the same spreadsheet.

Valuation matters for benchmarking, picking a startup with a successful exit matters in the end

Getting a lower percent equity in one offer compared to another offer doesn’t necessarily mean that offer is “worse”. Valuations, total number of employees, size of option pool, and a host of other factors often impact what equity % you will be offered. Given this, it’s helpful to benchmark equity in multiple ways.

Additionally, some startups have the potential to exit (meaning sell or go public) for much higher amounts than others. It’s helpful to look at other companies in the same space/incumbents to get a sense of good exit values. And some startups are more set up for success than others, so it’s important to thoroughly vet and evaluate the team when interviewing (you should be interviewing them as they interview you). If you pick the wrong company, equity is meaningless and you can even waste money on exercising it and paying taxes.

We are hosting an event on March 23rd at high noon (pt) to discuss how to evaluate marketing compensation in more detail. We’ll do a 20ish min presentation followed by Q&A. The conversation will focus on marketing, but non-marketers are welcome to attend.

The rest of this newsletter is valuable to anyone who receives an early or growth stage startup offer, not just marketers. There’s tons to learn here and I did my best to summarize.

Part 2: What you need to understand to value your equity offer

If you’re new to understanding equity, take a look through this section. If you need additional info, you may want to quickly read through a presentation I made about getting paid fairly for my previous side hustle, Help Wanted Project, that covers startup comp in more detail.

Equity basics

Here are some terms to familiarize yourself with:

What to ask about total compensation & equity

When you get an offer, all of the information to evaluate total compensation won’t be provided. Some companies go the extra mile here, but most don’t. The best way to make sure you are getting compensated fairly is to understand the process the company uses to determine salary and equity. A slightly lower offer at a company that is thoughtful about transparency, fairness, and candidate experience overall, is often a better long-term deal than the higher offer (IMO). Other things we won’t cover here, like longer post-termination exercise windows, early exercise, and favorable liquidation preferences also make equity more “valuable” IMO.

To do this, make sure you understand their compensation and leveling methodology. That said, early-stage startups don’t often have super robust processes, but you want to know they’ve at least given a compensation process some thought. I wrote a longer post on this here.

How to calculate the “value” of your equity

As I mentioned, you’ll need some info in advance to benchmark your equity. You’ll likely be given shares granted and strike price in your offer; this info is relatively meaningless without additional data points to make calculations. You’ll need to ask for total shares outstanding (or percent ownership) and most recent valuation (or preferred price).

We recommend using these 3 methods to evaluate your equity offer

We’ve mentioned a few methods for valuing and benchmarking your equity, here we break this down. Use the calculators “Calculating the value of your equity offer” for methods 1 and 2 and “Hypothetical exit values” for method 3 in the spreadsheet.

Method 1: Calculate % ownership

Especially useful at Seed & Series A, when current value might be low due to company valuation.

Use the formula shares granted / total shares outstanding to calculate and then compare to % ownership benchmarks for similar roles at similar stages (or similar valuations)

Method 2: Calculate current “market” value of your option

Current value takes into account current post-money valuation, whereas % ownership doesn’t.

Current value is a good proxy for what your equity (if fully vested) is hypothetically “worth” today. Meaning if the company hypothetically sold at the valuation at the last fundraising round today, what would you receive if you got paid out for all your options (even those unvested)?

This method is especially useful after Seed & Series A, when % ownership becomes much lower and company valuation comes more into play.

Method 3: Calculate some hypothetical exit scenarios

This method answers the question, if this company exits at $X, how much will I (maybe) get? The calculator gives you a very rough, very hypothetical value, since predicting these variables exactly is pretty impossible (unless you have magical powers, if so call me).

This is a helpful method for comparing multiple offers across multiple stages. To do that, also take into account the likelihood of an exit.

To calculate hypothetical exit scenarios, add different valuations at exit, include number of rounds before exit, and dilution %, etc. Keep in mind the calculator we provide doesn’t take into account things like liquidation preferences.

There’s so much more to say on all of this: From post-termination exercise windows to tax implications, but we did our best to cover the basics. If you want to learn more, reminder to come to our event.

We’re open to feedback on all of this info. It’s not perfect. If anything seems off or needs edits, let Emily know—especially if there’s a botched calculation or formula.

Opportunities for marketers

New roles

If you are looking for a new early-stage role, we do a few free coaching sessions a month for senior candidates and/or we can connect you asynchronously with roles that might be a fit.

And here are some featured roles from our job board:

Feel free to reach out to us directly if any of our fit, using this form.

Head of Marketing

PMM:

Content:

Growth & Demand Gen:

You may have noticed a hiatus in newsletter writing. We didn’t run out of ideas, we’ve just been busy working on some new initiatives—and this post is a behemoth.

And as a reminder, MKT1 does a lot of things to help build SaaS marketing functions: 1. We invest out of our fund and through our syndicate.

2. We mentor marketing leaders at Series A & B companies.

3. We help founders on a short-term advisory basis.

2 and 3 are very limited availability, but we do welcome cold outreach for all 3 things.

Thanks!

Fine print: This is not financial advice. This is based on anecdotal, aggregated, anonymized data (not statistically significant data), there may be errors in formulas (I tried my best and am open to feedback and edits).

Thanks for taking the time to share this, so many people ought to benefit from such in-depth research given away for free.

Great write up Emily and Kathleen. For marketers targeting Seed & Series A positions, it might be good to also touch on the QSBS tax exemption/requirements, given how impactful it could be for folks.