The startup ecosystem needs more marketers to invest

A guide to angel & fund investing for marketers

The best products don’t win. To succeed, startups must have a great product, founders, and win on go-to-market. Yet founders don’t have this skill set. Investors don’t have this skill set. And marketers don’t invest—less than 1% of investors are marketers.

So, we have a huge gap in the startup ecosystem—investors who help founders with marketing. Meaning, there's a huge opportunity for you as a marketer to get on cap tables. You can get allocation other investor can't get because of your unique value add, we've seen this first hand at MKT1 Capital. And you can be super impactful once you do invest, leading to more deal flow.

Kathleen and I did just this. We recognized that we can help in a massively underserved area to founders, began advising and angel investing, and eventually started our fund MKT1 Capital. If you are thinking about diving in and investing now is a great time–as even fewer people are investing during the downturn and valuations are lower. If now isn’t the right time (we know it’s a tough financial time for many), hopefully this newsletter lays out a path for you in the future.

And for founders reading this: Some marketer investors do exist, we’re trying to get more to exist. Once on your cap table, marketers will drive outsized impact due to their unique value add. If you need to get in touch with any just let us know via our pitch form.

This newsletter covers:

Venture investing overview (not marketer specific)

How to add value as a marketer investor

How to evaluate investments (and apply a marketing lens to evaluating them)

MKT1 Capital investment opportunity

Warning label: This post is meant to provide valuable, unbiased info on how and why to invest in startups and/or funds as a marketer. While we try to avoid being overly promotional in this newsletter, we will promote investing in our fund a bit at the bottom. Legal small print: None of this is financial advice at all. Talk to a certified professional for that.

Talks & Courses

If you want to learn more about investing as a marketer, come to our talk next week on 5/11. It’s free. We will bring to life the topics in this newsletter–and we’ll leave time for Q&A and tell you a bit more about MKT1 Capital if you’d like to get involved.

This event has now happened, here’s a video from the talk:

Our next cohort of our popular Building B2B Marketing course on Maven also kicks off next week. We have a few more spots for B2B Startup Marketing Leaders. (note: this course isn’t for founders, but we’ll launch a course for founders soon).

Venture investing overview

Build a portfolio to drive returns

Before you start investing in venture—or really in anything—figure out why you are doing it. If you want to make money, recognize that venture investing is a game of outliers. One company can, and often does, return your entire portfolio of investments.

If you just want to help friends out and invest, and don’t care about a return, building a diversified portfolio matters a bit less. But why not do both, build a portfolio that can drive returns and invest in friends and your community.

Angel investing vs. fund investing

Many marketers just think about angel investing directly through founders–-but you can also invest in startups through syndicates or even invest in funds as a limited partner or “LP”. If you are trying to build that portfolio I mentioned, fund investing can be a fast way to do it. Think of it like investing in a mutual fund vs. an individual stock. For more on the differences between investing in stock vs. venture vs. real estate, AngelList breaks it down here.

Here are the details on the differences:

Larger chart with all the detailed differences, including info about RUVs and Rolling Funds here, it was way too big for a newsletter.

How much do I need to invest?

You can invest as little as $1K in startups through syndicates and ~$10K+ as an angel. Most funds have higher check size minimums, but in the case of MKT1 Capital, we have a reduced minimum for marketers of $25K (more on MKT1 Capital below).

Where do deals come from?

The number one question I get from marketers thinking about angel investing is “Where do you find these deals?” I wish I had a super concrete answer, but really it’s a relationship game. That said, here are some ways to source deals–we’ve personally used all of these methods:

Founders from your network

Other angel investors you know (just check the LinkedIns of your friends, most investors make every effort to tell you they are an investor)

Let other angels know you are starting to invest

Form or join a group to share deals

Ask to tag along to pitch meetings

Tell VCs from previous companies you’ve worked at that you're investing

Explain very specifically how you help startups (“I help with marketing ops, like guidance on Hubspot set up”)

Sign up for AngelList Syndicates

It’s zero commitment to invest in deals that are posted by syndicates, so you can just see deals this way with no commitment necessary

Note: syndicates are not nearly as active as they were in 2020 & 2021 (which is probably a good thing)

Join Slack groups for angels or join a program led by VCs for angels, like Hustle Fund Angel Squad or First Round Angel Track

THE KEY TO GETTING DEAL FLOW & BEING REALLY HELPFUL AS AN INVESTOR:

Become the go-to angel investor for “x”. For us, it’s building your B2B marketing function, but you can be even more specific and niche and still get into deals and add value.

Actually help with that THING–to the extreme. Write about it, podcast about it, talk about it on LinkedIn, make templates for it, etc. Build your personal brand around it.

How to add value as a marketer investor

If you are a marketer who wants to invest, and qualify as an accredited investor, you should get out there and get started! Founders really do love (and need!) help from marketer investors. (Note: Accredited investor just means you meet certain income or assets requirements or have passed the Series 7, 65, or 82 financial exams. There’s no actual accreditation process),

The topics we write about in the MKT1 newsletter are the areas we most frequently get asked to help with—which is not a coincidence. Feel free to copy things we’ve said, we don’t mind 😊. More specifically, we most often get asked for help with marketing hiring; contractor/agency recommendations; fundraising announcements / PR; positioning, messaging, overall story; marketing ops, tooling, measurement; how to redo/update the website; what channels to use / tactics to try; content ideas; and pricing/packaging. If you can help in any of these areas, you can be a value-add marketer investor.

Based on your marketing skillset, here’s how you can help:

Another quick note on scaling your help as an investor: We all have limited time, especially if you have a full-time role while investing. The way we scale ourselves as just 2 people running a fund, producing lots of content, and teaching courses:

We focus our attention as investors on the areas of highest impact. We don’t dive in or give feedback on every little thing.

We let little things go that may bug us about a portfolio company’s marketing efforts because it’s not high leverage for anyone.

We take a “teach them to fish” attitude, create lots of templates, content like these Newsletters, and lists, which helps us scale our help. On that note, writing a newsletter and angel investing go together like chocolate and peanut butter—one makes the other better.

How to evaluate investments

Hopefully you're convinced you can help startups—honestly you’ll probably find that to be the easy part once you get started. The harder part IMO is evaluating deals and making the decision to invest.

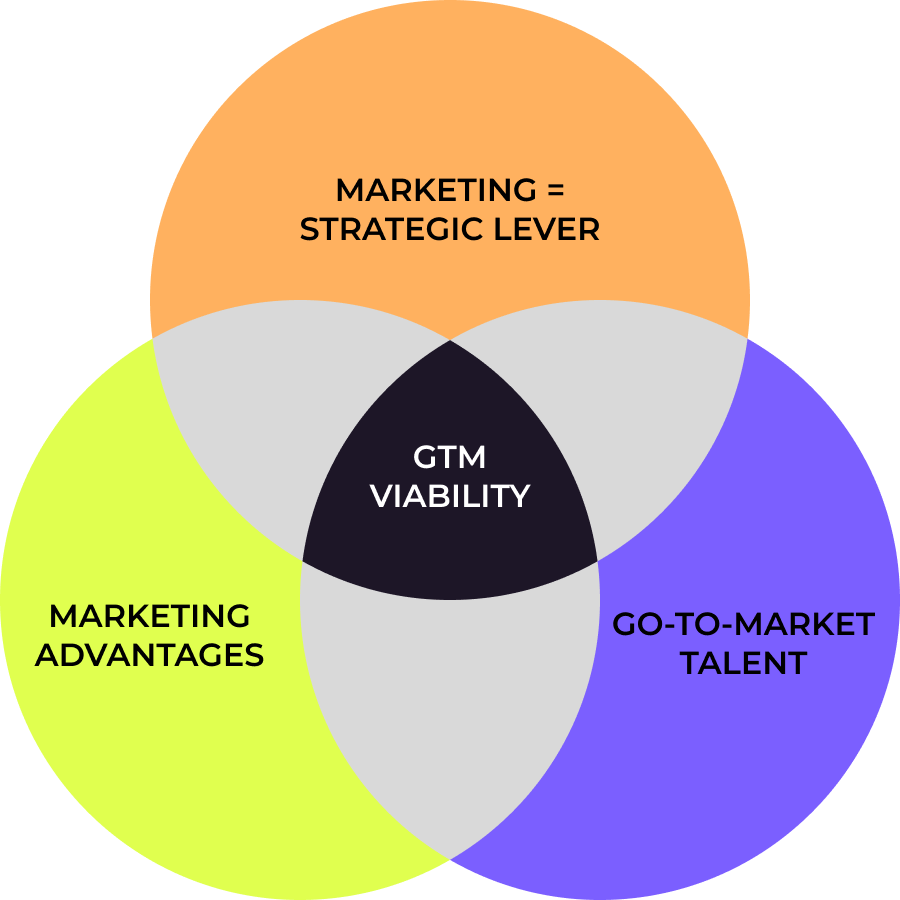

We evaluate founders, team, product, business model, market, and potential for outsized returns. But we also rely on our experience to assess go-to-market viability, which is often overlooked by investors and we think is a critical ingredient to win as a startup.

GTM viability is the ability to succeed in marketing and go-to-market overall. Startups need to not only build a great product, but actually take it to market, earn revenue, and grow quickly. We look for teams that have go-to-market skillsets or the ability to hire for these skillsets. We also looking for founders who approach marketing as a strategic lever (aka they value marketing).

Being able to succeed at go-to-market doesn’t just involve the team, it also depends on the product, business, and market. So, we evaluate each startup for “marketing advantages”, which are indicators of high-growth potential and key drivers of successful marketing strategies.

You’re welcome to adopt this framework for evaluation ability to go-to-market for your own angel investing–we believe it gives us a leg up.

Meeting with founders / pitch process

If you are angel investing directly in a startup, you will talk to the founder. Even now, it’s competitive to get into the best deals. My number one tip for these founder pitch conversations is to be helpful from the first meeting.

Much like when you interview someone for a role, you are both evaluating the individual and selling them on the role in the same conversation. It’s the same when you’re trying to get into a deal. I think of the first conversation I have with a founder as ~60-70% of them selling me on why I should invest, and ~30-40% of me pitching them on why I’m a great person to have on the cap table. If there’s a second conversation, this percentage often flips. As they are talking about GTM strategy, I’ll share anecdotes of what others have done, ask if they've given any thought to hiring a first marketer, provide content and channel ideas, etc.

Just today we got feedback from a founder in an email, “Our conversation felt more like a jam session than a pitch and I appreciated that.” We think natural conversations are the best way to learn if both sides want to work together, which is why we also don’t recommend founders walk through the deck during a call. Decks should be a pre-read and you can dive into specific slides if needed.

Some additional tips on how to make the most out of the founder pitch process:

Before the call…

Get the deck, review it

Make a list of questions

Think of how you can help specifically

Check for connections in common

During the call…

Give a brief intro to yourself (2 mins)

Ask for an overview of the founding story and startup

Ask to see a demo if there is time

Start helping / giving input in your area of expertise

Don’t commit on the call–sleep on it!

When you’ve made a decision:

Yes! Send an email telling them why you are excited and how you can help. Give the amount you’d like to invest.

No. Send an email as promptly as you can and either provide feedback from your unique perspective on how they can succeed and/or explain why you aren’t investing

Also, thank the person who sent you the intro and share the investment decision and why – this goes a long way.

How to get started: MKT1 Capital opportunity

Note: Since publishing, MKT1 Capital Fund I is now closed. We’ll let newsletter subscribers know when we have future investment opportunities.

We’re biased, but we think one of the best ways to get started investing in venture as a marketer is to invest in our fund. We have over 50 marketer LPs (investors in our fund) already and about half of them have never invested in startups or funds before.

If you are not a marketer, but believe startups who win at distribution are more likely to succeed, we’d also love you to invest. We have founders, GPs, product operators, sales operators, etc. as LPs.

One of my first investments was actually in a fund, followed by syndicate investing, followed by angel investing, followed by starting my own syndicate, and finally starting MKT1 Capital. You never know where that first angel investment will lead you–I thought I’d still be leading marketing at startups right now.

We have 3 goals for MKT1 Capital, one of which is to give marketers in our broader community an on-ramp into investing:

📈 Produce outsized returns for our Limited Partners (all funds should have this goal)

🏆 Advocate for and educate about marketing to founders, leaders, investors, etc.

🧲 Bring more marketers into the MKT1 community (that’s you): We want more marketers on cap tables. We believe marketers, founders, and other investors all benefit when more marketers invest and help startups.

Benefits to MKT1 Capital investors

When you invest in MKT1 Capital, it's totally optional to help us or help our startups. Either way, we want to help you, here's how we do that:

🎤 Collab with us: Speak at MKT1 events, write guest posts in our newsletter, etc. if you want to grow your personal brand.

👩🚀 Recruiting: We can help you find new roles, whether full-time, consulting, or advising. We can also help you hire on your marketing team by referring candidates we meet.

🤝 Marketing friends: We can connect you with other marketers for whatever you need.

😇 Deal flow: We share angel deals with our LPs when founders are open to it and will soon do that via Slack.

📚 Discounted access to our paid community, courses, content, talks, and templates for marketers.

Watch the video form our angel investing talk, including more detail on MKT1 Capital.

MKT1 Job Board

Jobs from when we initially send this email have been filled, check out current opportunities here.

Thanks for reading this slightly different MKT1 Newsletter. We also are just about to hit 25,000 subscribers, and we’ve 8Xed over the last year. Thanks for helping us hit this milestone—we appreciate all the support.

-Emily & Kathleen